What Determines The Monetary Value Of A Good Or Service Quizlet

Market Differences Between Monopoly and Perfect Competition

Monopolies, as opposed to perfectly competitive markets, accept high barriers to entry and a single producer that acts every bit a price maker.

Learning Objectives

Distinguish between monopolies and competitive firms

Key Takeaways

Central Points

- In a perfectly competitive market, there are many producers and consumers, no barriers to leave and entry into the marketplace, perfectly homogenous goods, perfect information, and well-defined property rights.

- Perfectly competitive producers are cost takers that tin can choose how much to produce, but not the price at which they tin sell their output.

- A monopoly exists when in that location is only one producer and many consumers.

- Monopolies are characterized by a lack of economic contest to produce the proficient or service and a lack of viable substitute goods.

Key Terms

- perfect competition: A type of market with many consumers and producers, all of whom are price takers

- network externality: The effect that ane user of a good or service has on the value of that product to other people

- perfect information: The assumption that all consumers know all things, well-nigh all products, at all times, and therefore always make the best conclusion regarding purchase.

A market tin be structured differently depending on the characteristics of competition within that market. At 1 extreme is perfect competition. In a perfectly competitive marketplace, there are many producers and consumers, no barriers to enter and exit the market, perfectly homogeneous appurtenances, perfect data, and well-defined property rights. This produces a system in which no individual economic actor can impact the cost of a good – in other words, producers are toll takers that can choose how much to produce, but not the cost at which they tin sell their output. In reality there are few industries that are truly perfectly competitive, but some come up very close. For example, commodity markets (such as coal or copper) typically have many buyers and multiple sellers. At that place are few differences in quality betwixt providers and so goods can be easily substituted, and the appurtenances are simple enough that both buyers and sellers have full information about the transaction. It is unlikely that a copper producer could raise their prices above the market place rate and still find a buyer for their product, so sellers are price takers.

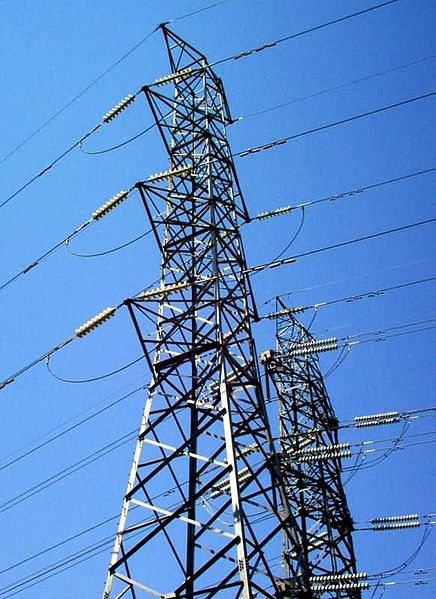

A monopoly, on the other hand, exists when there is simply one producer and many consumers. Monopolies are characterized past a lack of economical contest to produce the practiced or service and a lack of viable substitute goods. As a result, the single producer has control over the price of a expert – in other words, the producer is a cost maker that can decide the price level by deciding what quantity of a practiced to produce. Public utility companies tend to exist monopolies. In the instance of electricity distribution, for example, the toll to put upward ability lines is so high it is inefficient to take more than ane provider. There are no skilful substitutes for electricity delivery so consumers take few options. If the electricity benefactor decided to raise their prices it is likely that most consumers would proceed to purchase electricity, so the seller is a price maker.

Electricity Distribution: The price of electrical infrastructure is and then expensive that in that location are few or no competitors for electricity distribution. This creates a monopoly.

Sources of Monopoly Power

Monopoly power comes from markets that accept loftier barriers to entry. This can be caused by a variety of factors:

- Increasing returns to scale over a big range of production

- Loftier capital requirements or large inquiry and development costs

- Production requires control over natural resources

- Legal or regulatory barriers to entry

- The presence of a network externality – that is, the employ of a product by a person increases the value of that product for other people

Monopoly Vs. Perfect Competition

Monopoly and perfect competition marking the two extremes of market structures, but at that place are some similarities between firms in a perfectly competitive market and monopoly firms. Both face the same cost and production functions, and both seek to maximize profit. The shutdown decisions are the same, and both are assumed to have perfectly competitive factors markets.

Notwithstanding, at that place are several key distinctions. In a perfectly competitive marketplace, toll equals marginal cost and firms earn an economic turn a profit of zero. In a monopoly, the price is set above marginal cost and the firm earns a positive economic profit. Perfect contest produces an equilibrium in which the cost and quantity of a good is economically efficient. Monopolies produce an equilibrium at which the price of a practiced is higher, and the quantity lower, than is economically efficient. For this reason, governments often seek to regulate monopolies and encourage increased contest.

Marginal Acquirement and Marginal Cost Relationship for Monopoly Production

For monopolies, marginal price curves are upward sloping and marginal revenues are downward sloping.

Learning Objectives

Analyze how marginal and marginal costs affect a visitor'southward production decision

Key Takeaways

Key Points

- Firm typically have marginal costs that are depression at depression levels of production merely that increase at college levels of production.

- While competitive firms feel marginal revenue that is equal to price – represented graphically by a horizontal line – monopolies have downward-sloping marginal acquirement curves that are different than the good's toll.

- For monopolies, marginal revenue is ever less than cost.

Key Terms

- marginal revenue: The additional profit that will be generated past increasing product sales by one unit.

- marginal toll: The increment in cost that accompanies a unit of measurement increase in output; the partial derivative of the cost function with respect to output. Additional cost associated with producing i more unit of output.

Profit Maximization

In traditional economic science, the goal of a business firm is to maximize their profits. This means they want to maximize the deviation between their earnings, i.e. revenue, and their spending, i.e. costs. To find the profit maximizing point, firms wait at marginal revenue (MR) – the total additional revenue from selling one boosted unit of output – and the marginal cost (MC) – the full additional cost of producing i additional unit of output. When the marginal revenue of selling a good is greater than the marginal price of producing it, firms are making a profit on that product. This leads directly into the marginal conclusion rule, which dictates that a given good should continue to be produced if the marginal revenue of one unit of measurement is greater than its marginal cost. Therefore, the maximizing solution involves setting marginal acquirement equal to marginal cost.

This is relatively straightforward for firms in perfectly competitive markets, in which marginal revenue is the same equally price. Monopoly production, still, is complicated by the fact that monopolies take demand curves and MR curves that are distinct, causing price to differ from marginal revenue.

Monopoly: In a monopoly marketplace, the marginal revenue curve and the demand curve are singled-out and downwards-sloping. Product occurs where marginal cost and marginal revenue intersect.

Perfect Competition: In a perfectly competitive market, the marginal revenue bend is horizontal and equal to demand, or price. Product occurs where marginal cost and marginal acquirement intersect.

Monopoly Profit Maximization

The marginal cost curves faced by monopolies are like to those faced past perfectly competitive firms. Well-nigh volition accept depression marginal costs at low levels of product, reflecting the fact that firms tin have advantage of efficiency opportunities as they begin to grow. Marginal costs get higher as output increases. For example, a pizza restaurant can easily double production from one pizza per 60 minutes to two without hiring boosted employees or ownership more sophisticated equipment. When production reaches 50 pizzas per hour, however, information technology may exist difficult to abound without investing a lot of money in more skilled employees or more loftier-tech ovens. This trend is reflected in the up-sloping portion of the marginal cost curve.

The marginal revenue curve for monopolies, yet, is quite unlike than the marginal revenue curve for competitive firms. While competitive firms experience marginal acquirement that is equal to toll – represented graphically by a horizontal line – monopolies take downward-sloping marginal acquirement curves that are different than the good's toll.

Profit Maximization Function for Monopolies

Monopolies set marginal toll equal to marginal acquirement in guild to maximize profit.

Learning Objectives

Explicate the monopolist's profit maximization function

Key Takeaways

Central Points

- The kickoff-gild condition for maximizing profits in a monopoly is 0=∂q=p(q)+qp′(q)−c′(q), where q = the profit-maximizing quantity.

- A monopoly'southward profits are represented by π=p(q)q−c(q), where revenue = pq and cost = c.

- Monopolies take the power to limit output, thus charging a higher price than would exist possible in competitive markets.

Key Terms

- commencement-order condition: A mathematical relationship that is necessary for a quantity to be maximized or minimized.

- deadweight loss: A loss of economical efficiency that can occur when an equilibrium is not Pareto optimal.

Monopolies take much more than ability than firms normally would in competitive markets, merely they still face limits determined past demand for a product. Higher prices (except under the most extreme conditions) hateful lower sales. Therefore, monopolies must make a decision about where to prepare their price and the quantity of their supply to maximize profits. They can either cull their price, or they tin cull the quantity that they will produce and permit market need to fix the cost.

Since costs are a office of quantity, the formula for profit maximization is written in terms of quantity rather than in cost. The monopoly's profits are given past the following equation:

π=p(q)q−c(q)

In this formula, p(q) is the price level at quantity q. The cost to the firm at quantity q is equal to c(q). Profits are represented past π. Since revenue is represented past pq and price is c, profit is the difference between these two numbers. As a result, the first-order condition for maximizing profits at quantity q is represented past:

0=∂q=p(q)+qp′(q)−c′(q)

The to a higher place first-guild condition must always be true if the house is maximizing its profit – that is, if p(q)+qp′(q)−c′(q) is not equal to naught, then the firm tin can change its cost or quantity and make more profit.

Marginal revenue is calculated by p(q)+qp′(q), which is derived from the term for acquirement, pq. The term c′(q) is marginal cost, which is the derivative of c(q). Monopolies will produce at quantity q where marginal revenue equals marginal cost. So they volition charge the maximum price p(q) that market place need will respond to at that quantity.

Consider the example of a monopoly firm that can produce widgets at a toll given by the following function:

c(q)=2+3q+q2

If the firm produces two widgets, for example, the full cost is 2+iii(2)+22=12. The price of widgets is determined by need:

p(q)=24-2p

When the firm produces ii widgets it tin can accuse a price of 24-2(two)=twenty for each widget. The business firm'southward profit, every bit shown higher up, is equal to the difference between the quantity produces multiplied by the price, and the total cost of production: p(q)q−c(q). How can we maximize this function?

Using the outset gild condition, nosotros know that when turn a profit is maximized, 0=p(q)+qp′(q)−c′(q). In this case:

0=(24-2p)+q(-2)-(3+2q)=21-6q

Rearranging the equation shows that q=3.v. This is the profit maximizing quantity of production.

Consider the diagram illustrating monopoly competition. The cardinal points of this diagram are fivefold.

- First, marginal revenue lies below the demand curve. This occurs considering marginal revenue is the need, p(q), plus a negative number.

- Second, the monopoly quantity equates marginal revenue and marginal cost, but the monopoly cost is higher than the marginal toll.

- Third, there is a deadweight loss, for the aforementioned reason that taxes create a deadweight loss: The higher price of the monopoly prevents some units from being traded that are valued more highly than they toll.

- Fourth, the monopoly profits from the increment in price, and the monopoly profit is illustrated.

- Fifth, since—under competitive conditions—supply equals marginal price, the intersection of marginal price and demand corresponds to the competitive outcome.

We encounter that the monopoly restricts output and charges a higher price than would prevail under competition.

Monopoly Diagram: This graph illustrates the price and quantity of the market equilibrium nether a monopoly.

Monopoly Production Determination

To maximize output, monopolies produce the quantity at which marginal supply is equal to marginal cost.

Learning Objectives

Explicate how to place the monopolist'southward production bespeak

Key Takeaways

Cardinal Points

- Unlike a competitive visitor, a monopoly can decrease production in order to charge a higher price.

- Because of this, rather than finding the point where the marginal cost curve intersects a horizontal marginal acquirement curve (which is equivalent to good's price), we must find the point where the marginal cost curve intersect a downwards-sloping marginal acquirement curve.

- Monopolies have downward sloping need curves and downward sloping marginal acquirement curves that have the aforementioned y-intercept as need but which are twice equally steep.

- The shape of the curves shows that marginal revenue will always be below demand.

Key Terms

- marginal cost: The increment in cost that accompanies a unit increment in output; the partial derivative of the toll office with respect to output. Additional cost associated with producing one more than unit of output.

- marginal acquirement: The boosted turn a profit that volition exist generated by increasing product sales by one unit of measurement.

Monopoly Production

A pure monopoly has the same economical goal of perfectly competitive companies – to maximize profit. If we presume increasing marginal costs and exogenous input prices, the optimal conclusion for all firms is to equate the marginal cost and marginal acquirement of production. Nonetheless, a pure monopoly can – unlike a house in a competitive market – alter the market price for its own convenience: a subtract of production results in a higher price. Because of this, rather than finding the bespeak where the marginal toll curve intersects a horizontal marginal revenue curve (which is equivalent to good's toll), we must discover the point where the marginal cost bend intersect a downwardly-sloping marginal revenue curve.

Monopoly Production Signal

Like non-monopolies, monopolists will produce the at the quantity such that marginal revenue (MR) equals marginal cost (MC). However, monopolists have the ability to change the market place cost based on the corporeality they produce since they are the only source of products in the market place. When a monopolist produces the quantity adamant by the intersection of MR and MC, information technology can charge the price adamant by the market demand bend at the quantity. Therefore, monopolists produce less but charge more than a firm in a competitive market place.

Monopoly Production: Monopolies produce at the point where marginal revenue equals marginal costs, but accuse the price expressed on the marketplace need bend for that quantity of production.

In brusque, three steps tin decide a monopoly business firm's turn a profit-maximizing toll and output:

- Summate and graph the house's marginal revenue, marginal cost, and demand curves

- Place the point at which the marginal acquirement and marginal toll curves intersect and make up one's mind the level of output at that bespeak

- Apply the demand curve to find the price that can be charged at that level of output

Monopoly Price and Turn a profit

Monopolies can influence a good's cost by irresolute output levels, which allows them to make an economic profit.

Learning Objectives

Analyze the last price and resulting turn a profit for a monopolist

Cardinal Takeaways

Central Points

- Typically a monopoly selects a higher price and lesser quantity of output than a price-taking company.

- A monopoly, unlike a perfectly competitive firm, has the market all to itself and faces the downwardly-sloping market demand curve.

- Graphically, one tin observe a monopoly's toll, output, and profit past examining the demand, marginal cost, and marginal revenue curves.

Key Terms

- economical turn a profit: The difference between the total acquirement received by the firm from its sales and the total opportunity costs of all the resources used by the firm.

- demand: The desire to purchase goods and services.

Monopolies, unlike perfectly competitive firms, are able to influence the price of a expert and are able to brand a positive economical profit. While a perfectly competitive firm faces a single market place price, represented by a horizontal demand/marginal revenue curve, a monopoly has the market all to itself and faces the downward-sloping market demand curve. An important effect is worth noticing: typically a monopoly selects a higher price and lesser quantity of output than a toll-taking company; again, less is bachelor at a higher price.

Imagine that the market place demand for widgets is Q=30-2P. This says that when the price is one, the market will demand 28 widgets; when the cost is 2, the market will demand 26 widgets; and and so on. The monopoly'southward full acquirement is equal to the price of the widget multiplied past the quantity sold: P(xxx-2P). This tin can also be rearranged so that information technology is written in terms of quantity: total revenue equals Q(30-Q)/two.

The business firm tin produce widgets at a full price of 2Qii, that is, it can produce one widget for $2, two widgets for $8, three widgets for $18, and so on. Nosotros know that all firms maximize turn a profit by setting marginal costs equal to marginal acquirement. Finding this point requires taking the derivative of full revenue and total price in terms of quantity and setting the two derivatives equal to each other. In this example:

[latex]\frac{dTR}{dQ}=\frac{(30-2Q)}{2}[/latex]

[latex]\frac{dTC}{dQ} =4Q[/latex]

Setting these equal to each other: [latex]15-Q=4Q[/latex]

So the profit maximizing bespeak occurs when Q=three.

At this point, the price of widgets is $13.l, the monopoly's total acquirement is $xl.50, the total price is $xviii, and profit is $22.50. For comparing, it is easy to see that if the firm produced two widgets price would be $14 and profit would be $20; if it produced 4 widgets price would be $13 and profit would again be $20. Q=three must be the turn a profit-maximizing output for the monopoly.

Graphically, one tin find a monopoly's price, output, and profit by examining the demand, marginal price, and marginal revenue curves. Again, the house volition always set output at a level at which marginal cost equals marginal acquirement, and so the quantity is found where these two curves intersect. Toll, however, is determined by the demand for the good when that quantity is produced. Because a monopoly's marginal acquirement is always beneath the need bend, the price will always be to a higher place the marginal toll at equilibrium, providing the firm with an economic profit.

Monopoly Pricing: Monopolies create prices that are higher, and output that is lower, than perfectly competitive firms. This causes economic inefficiency.

Source: https://courses.lumenlearning.com/boundless-economics/chapter/monopoly-production-and-pricing-decisions-and-profit-outcome/

Posted by: williamsonlikeethimp.blogspot.com

0 Response to "What Determines The Monetary Value Of A Good Or Service Quizlet"

Post a Comment